Get Real-Time Guidance and Evaluation on a Devoted Forex Trading Forum

Get Real-Time Guidance and Evaluation on a Devoted Forex Trading Forum

Blog Article

Checking Out the Impact of Currency Exchange Fees on Your Investments

The influence of money exchange prices on investments is a nuanced topic that warrants mindful factor to consider, particularly for those involving in worldwide markets. Changes in exchange prices can suddenly alter the worth of foreign financial investments, influencing general portfolio efficiency. As investors navigate these complexities, recognizing the interaction in between money characteristics and property values comes to be vital. This discussion will highlight necessary techniques for mitigating currency threat, yet it also increases significant inquiries regarding how to successfully place one's profile in a significantly interconnected international economic climate. What effects might these understandings hold for your financial investment technique?

Recognizing Currency Exchange Rates

The details of currency exchange rates play an essential role in the international economic landscape, influencing investment decisions across borders. Currency exchange rates stand for the worth of one money in regard to one more and are figured out by different aspects, including interest prices, inflation, political stability, and financial efficiency. Comprehending these prices is vital for financiers participated in worldwide markets, as variations can significantly influence the earnings of investments.

At its core, a currency exchange rate can be categorized as either repaired or floating. Fixed currency exchange rate are fixed to a steady currency or a basket of money, providing predictability however restricting versatility. Alternatively, drifting exchange rates fluctuate based on market pressures, permitting for more receptive modifications to economic realities.

In addition, exchange rate movements can be affected by speculative trading, where capitalists get or market money in anticipation of future adjustments. Awareness of these characteristics makes it possible for financiers to make informed choices, minimize dangers, and take advantage of possibilities in the foreign exchange market. Eventually, a detailed understanding of currency exchange rates is essential for browsing the complexities of global financial investments properly.

Effects on International Investments

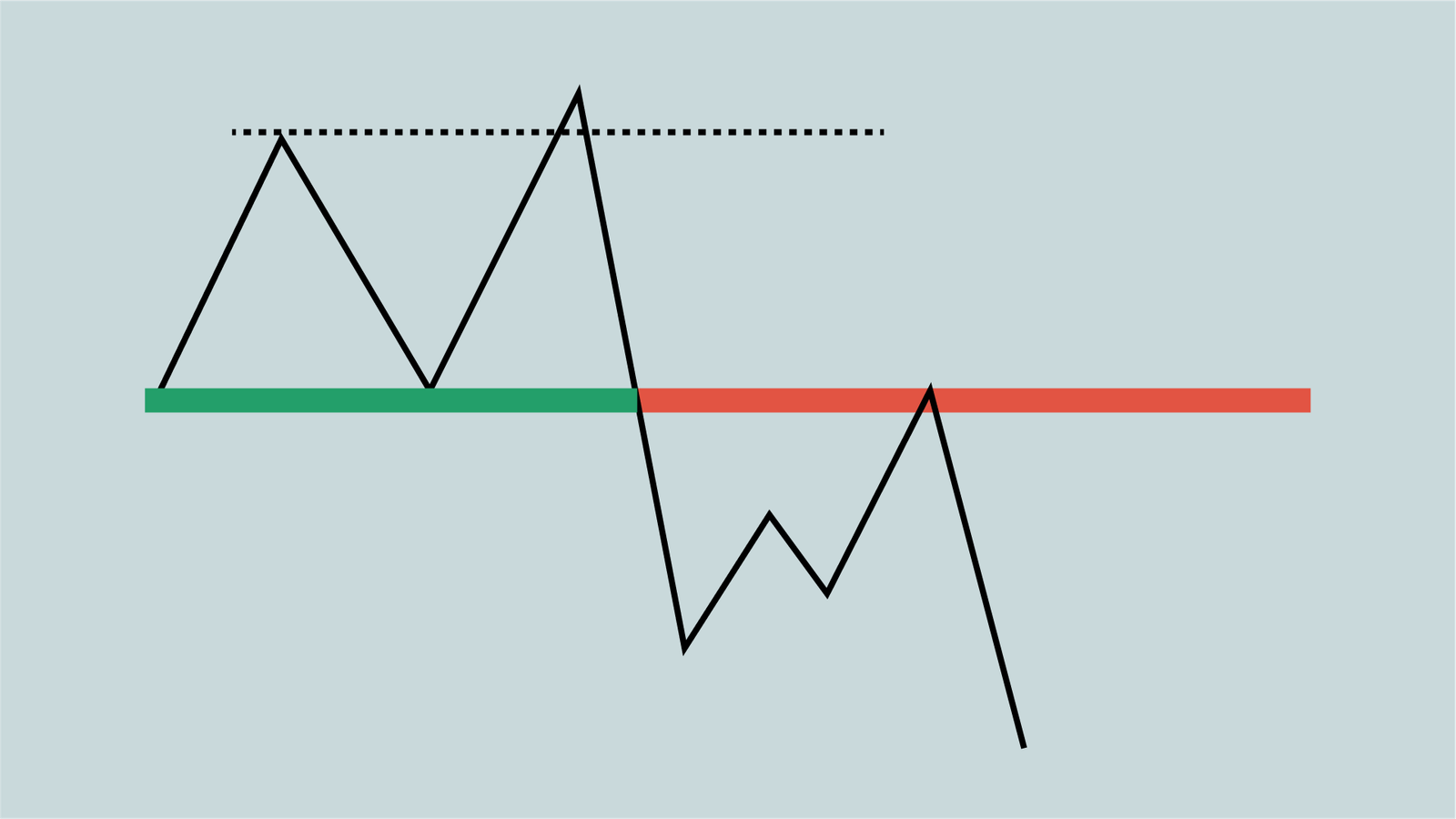

Fluctuations in currency exchange rates can considerably affect worldwide financial investments, influencing both the returns and threats linked with cross-border transactions. When a financier assigns capital to foreign markets, the worth of the financial investment can be impacted by shifts in the money pair in between the financier's home money and the international money. If the foreign money depreciates versus the financier's home money, the returns on the financial investment may diminish, also if the hidden possession executes well.

In addition, money risk is an inherent consider worldwide investments, requiring a careful evaluation of prospective volatility. This risk can cause unforeseen losses or gains, complicating the financial investment decision-making process. Financiers may mitigate this risk with different methods, such as currency hedging or diversification across several currencies.

In addition, currency exchange rate variations can likewise impact the attractiveness of international financial investments family member to domestic choices - forex trading forum. A solid home money might motivate domestic investors to look for chances abroad, while a weak home money may prevent investment in worldwide possessions as a result of regarded greater prices. Eventually, comprehending these effects is critical for investors aiming to maximize their global portfolios while managing currency-related threats successfully

Effect on Getting Power

Adjustments in money exchange prices can directly erode or enhance acquiring power, affecting consumers and capitalists alike. When a money enhances against others, it increases the purchasing power of customers holding that money, click here now permitting them to acquire more products and services for the very same quantity of money. Alternatively, a weakening money reduces purchasing power, making international items extra expensive and possibly leading to inflationary pressures locally.

For capitalists, the effects of changing currencies prolong past instant purchasing power. Investments in international markets can yield various returns when advice converted back to the investor's home currency. A solid home money can boost the worth of international financial investments upon repatriation, while a weak home currency can lower returns considerably.

Furthermore, fluctuations in currency exchange rate can influence customer behavior and investing patterns. A decline in buying power may create consumers to focus on essential items over high-end items, thus affecting the more comprehensive financial landscape. Consequently, comprehending the effect of currency exchange prices on purchasing power is essential for making informed financial choices, whether one is a consumer browsing day-to-day costs or a capitalist examining the practicality of global possibilities.

Methods for Currency Threat Administration

Another strategy is diversification, which requires spreading financial investments throughout various currencies and geographic areas. This minimizes exposure to any kind of single money's volatility, thereby stabilizing overall returns. Investors may additionally think about buying currency-hedged funds, which are particularly created to reduce money threat while still providing access to international markets.

Additionally, maintaining a close watch on economic indicators and geopolitical occasions can aid financiers make educated decisions concerning their money direct exposures. Carrying out a self-displined technique to money danger administration through routine evaluations and changes can additionally enhance durability versus negative exchange price activities.

Study and Real-World Instances

Just how do real-world situations show the complexities of money exchange rates on financial investment outcomes? The gains made in the supply market were offset by unfavorable exchange rate movements, showing how currency fluctuations can substantially affect investment useful site profitability.

Another illustrative example entails an international firm earning income in numerous money. An U.S. firm with considerable procedures in Japan saw its revenues eroded when the yen compromised versus the buck. This currency depreciation caused a reduction in reported profits, prompting the company to reassess its worldwide revenue technique.

These study emphasize the necessity for financiers to keep an eye on money exchange patterns proactively. They highlight that while straight investment performance is vital, the interplay of exchange rates can dramatically change general financial investment outcomes, necessitating a thorough method to run the risk of management.

Verdict

In verdict, currency exchange prices play an essential function in forming investment outcomes, particularly in worldwide markets. Fluctuations in currency exchange rate can improve or erode the worth of foreign possessions, therefore affecting total profile performance. An extensive understanding of these characteristics, paired with effective threat administration approaches such as hedging and diversification, is essential for investors seeking to optimize returns and minimize prospective dangers related to currency activities. Awareness of these variables is vital for educated financial investment decision-making.

Report this page